Home buyers in the Fraser Valley are enjoying a selection of homes for sale not seen in more than a decade. The growing inventory of more than 10,000 active listings means, in many cases, that buyers have time, selection and price negotiation on their side.

“There’s definitely a surge of activity in the market — buyers are out viewing homes and attending open houses,” said Tore Jacobsen, Chair of the Fraser Valley Real Estate Board. “What’s noticeable in the current market is the level of choice. A buyer might see a home they like and then have an opportunity to tour five or ten more just like it, without feeling rushed to make an immediate offer.”

However, despite the abundance of listings and potential buying opportunities, spring sales remain sluggish. The Fraser Valley Real Estate Board recorded 1,043 sales on its Multiple Listing Service® (MLS®) in April, up one per cent from March and down 29 per cent year over year. New listings declined slightly in April, down one per cent from March.

The overall sales-to-active listings ratio indicates a buyer’s market in the Fraser Valley, with a ratio of 10 per cent. The market is considered to be balanced when the ratio is between 12 per cent and 20 per cent.

Across the Fraser Valley in April, the average number of days to sell a single-family detached home was 32, while for both townhomes and condos it was slightly lower at 29 days.

Tariffs and economic uncertainty continue to weigh heavily on the minds of home buyers in the Fraser Valley,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “However, with the federal election now behind us and a new administration in place, there’s cautious optimism that a fresh approach to strengthening the economy could be on the way, which is welcome news for the real estate sector.”

The composite Benchmark price in the Fraser Valley decreased 0.2 per cent in April, to $972,700.

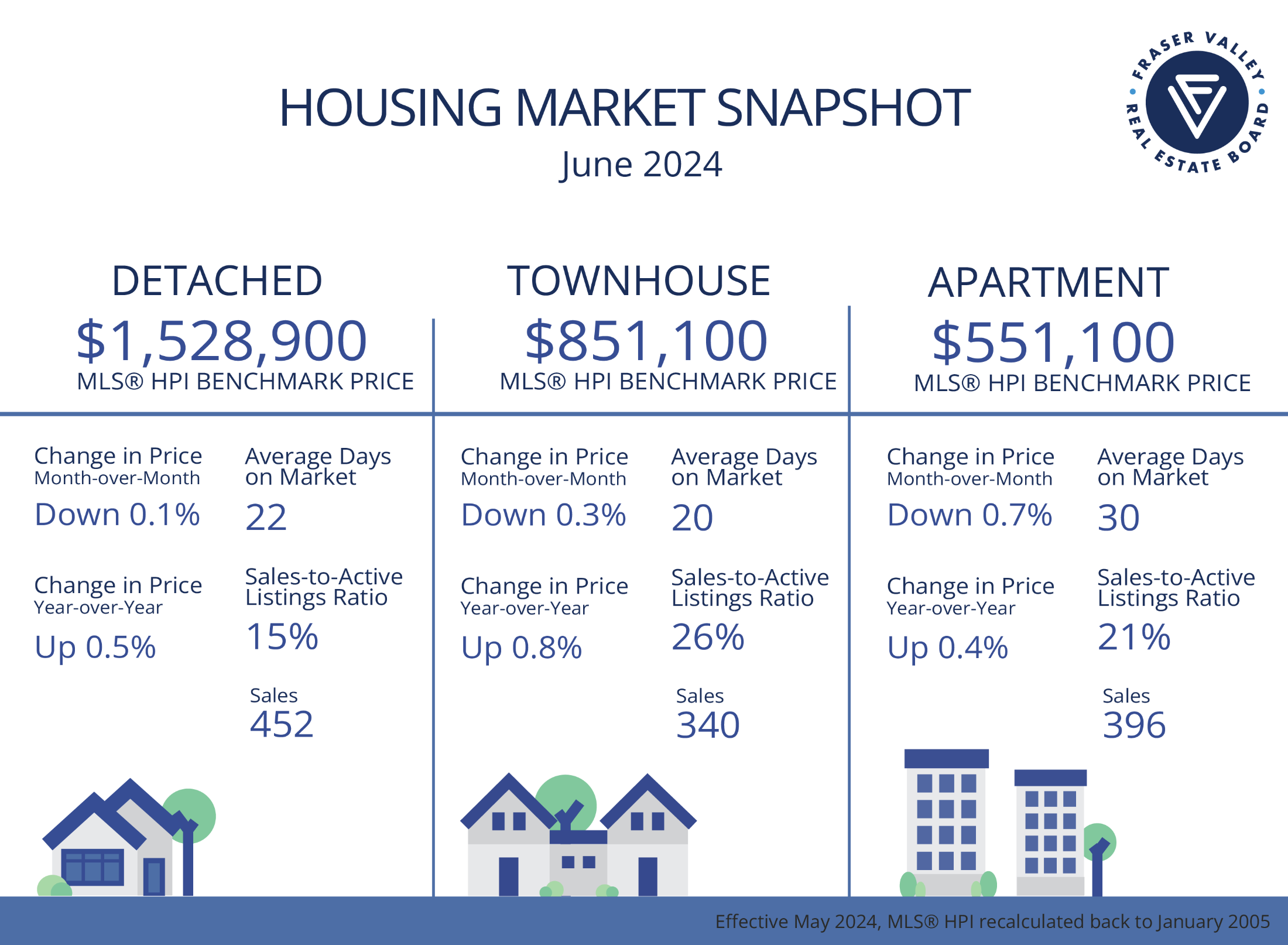

MLS® HPI Benchmark Price Activity

Single Family Detached: At $1,506,600, the Benchmark price for an FVREB single-family detached home increased 0.1 per cent compared to March 2025 and decreased 1.3 per cent compared to April 2024.

Townhomes: At $833,100 the Benchmark price for an FVREB townhome decreased 0.1 per cent compared to March 2025 and decreased 2.4 per cent compared to April 2024.

Apartments: At $537,800 the Benchmark price for an FVREB apartment/condo decreased 0.6 per cent compared to March 2025 and decreased 3.2 per cent compared to April 2024